when are property taxes due in illinois 2019

If you have delinquent. Ad Prepare your 2019 state tax 1799.

Normal We Must Entertain And More Entertaining Government Organisation Community College

100 Free Federal for Old Tax Returns.

. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Corporate purposes general fund including amounts for fire protection ambulance services and imrf. Mobile Home taxes are due on April 22 2019.

Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free. Tax Year 2020 Second. Tax amount varies by county.

Tax Year 2021 First Installment Due Date. 100 Free Federal for Old Tax Returns. Collecting property taxes on real estate and mobile homes.

Residents wanting information about anything related to property taxes or fees paid to the county can click through the links. The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Illinois income taxes on April 15 2020 are automatically extended until July 15 2020. Delinquent Property Tax Search.

The first installment is due 30 days after the bill is mailed and the second installment is due September 1 unless that falls on a weekend or. Jenny White DOCKET NO. ILLINOIS PROPERTY TAX APPEAL BOARD PTABJLG4-22 APPELLANT.

Illinois Property Tax Rates. 1 hour agoThe median Illinois home sale in 2019 was 208965. 15 penalty interest added per.

Thirty-year mortgage rates have. Welcome to Madison County Illinois. A difference of 38961.

A 25 late penalty will be assessed on April 23 2019. February 14 through Tuesday March 2 2022 2019 Annual Sale. Property tax bills mailed.

Last day to submit changes for ACH withdrawals for the 1st installment. Property tax due dates for 2019 taxes payable in 2020. Check to see if your taxes are past due.

The 2017 sale was included due to the fact that. 173 of home value. The typical homeowner in illinois pays 4527 annually in.

Tuesday March 1 2022. Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free. Specific tax rates in Illinois are determined based on the total tax base or the total value of property with a district.

Tax bills are mailed out in May each year. 1st installment due date. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

When are property taxes due in illinois 2019 Sunday April 24 2022 Edit The phone number should be listed in your local phone book under Government County Assessors. While Illinois home values dropped property taxes increased by. Penalty be assessed for payments made.

In the second year of the property tax cycle. The Illinois Department of Revenue does not administer property tax. It is managed by the local governments including cities counties and taxing districts.

Cook County Treasurers Office - Chicago Illinois. Today that same house would go for an estimated 247926. Ad Prepare your 2019 state tax 1799.

In the calendar year 2019 we will be paying real estate taxes for the 2018 year. A 50 late penalty will be assessed on May 23 2019.

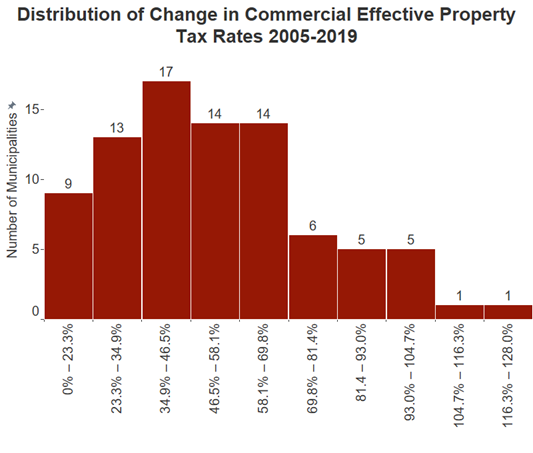

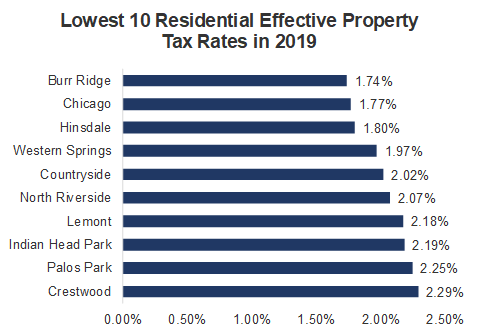

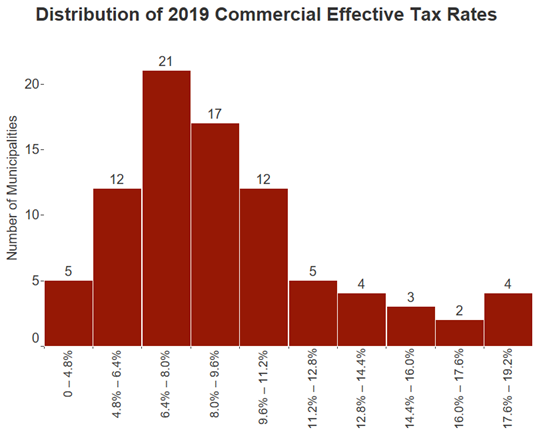

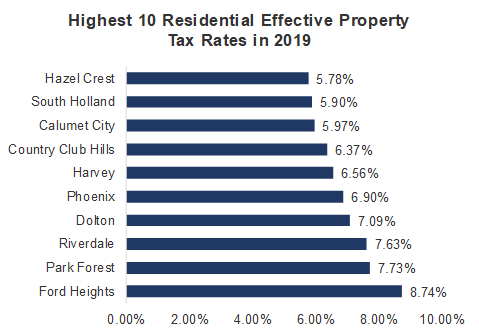

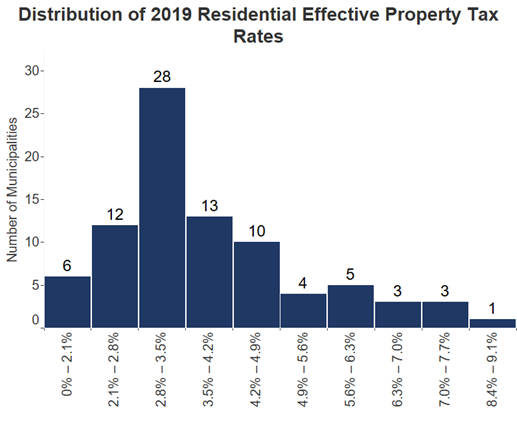

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Who Pays Taxes In America In 2019 Itep

Illinois Income Tax Rate And Brackets 2019

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Montgomery County Courthouse Sign In Hillsboro Illinois Paul Chandler February 2019

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

The Shutdown Of Businesses Across The Country Is Casting A Pall Over A Segment Of The 3 9 Trillion Municipal Bond Market That Had B Sales Tax Tax Filing Taxes

Primera Ins Tax Services On Instagram Tis The Season For Tax Preperation Did You Know The Easies Financial Institutions Tax Software Best Tax Software

Who Pays Taxes In America In 2019 Itep

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Property Tax City Of Decatur Il

Property Tax Prorations Case Escrow

These Are The Best And Worst States For Taxes In 2019

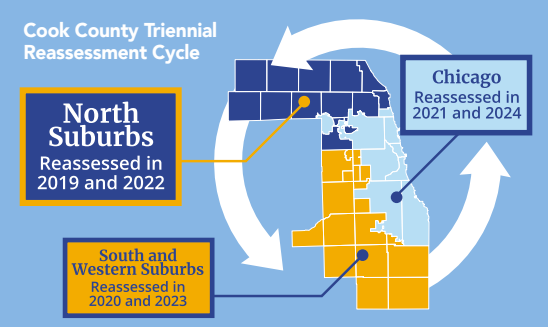

The Cook County Property Tax System Cook County Assessor S Office

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Tax Information Village Of River Forest

Ranking Of Best Places To Buy A House In The Austin Area Market Based On Home Values Property Taxes And Austin Ar Houses In Austin Real Estate Home Ownership